In the 1970s Charles Schwab transformed the advice industry by undercutting traditional Wall Street brokerage firms with prices of $70 per trade. Schwab has since grown to more than $2 trillion in assets, including its RIA business. Today discount brokerages such as E*TRADE, Vanguard, and Fidelity continue to steal assets away from large, traditional Wall Street firms by attracting customers that want lower fees or want to feel more in control of their savings.

Today, we may be at another such turning point in the market. Following the financial crisis, there is a wave of new startups that are trying to redefine or refresh traditional models of wealth management. Their services are priced to sell, and traditional firms have not been able to deliver the quality of customer experience of these startups, in part because they are dragged down by the sheer weight of incumbency--unable to adapt their infrastructure quickly and drawing comfort from the slow pace of adoption of the new players and their offerings. Many of these emerging players appeal to so-called “mass affluent” investors, with $100,000 to $500,000 in investable assets, who the traditional private banks and retail brokerages have been unable to serve effectively.

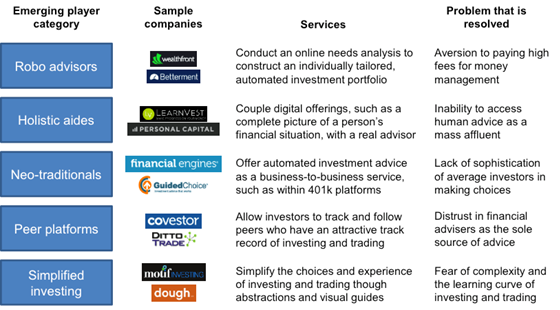

It helps to classify these players and their services—see Exhibit 1.

Exhibit 1: Non-traditional wealth management firms

While the offerings detailed above serve a variety of customer types and needs, over the last few years, we have noticed that there is a convergence in what these players offer. For example, SigFig started out as the Mint.com of investing, offering customers the ability to aggregate their investments, and helping customers to monitor their portfolios. SigFig has since expanded its offering to include an automated investment management product, presumably in an attempt to diversify its revenue stream. Covestor started out as a “peer platform”, but has since mimicked features of a “holistic aide”, with a needs analysis that helps customers narrow down which investment managers are most suited to their needs. Learnvest is evolving from a “holistic aide” that connects investors with advisors to a “neo-traditional” offering that is now launching an institutional business serving asset managers.

From 0 to 60 in three seconds?

These startups have grown at various rates, giving us an early indication of which business model is most likely to win. SigFig has more than $300 billion of advised assets on its platform. Robinhood, a commission-free trading company founded in 2013, now has a wait list of nearly 500,000 people. Certain firms have started to grow more quickly in the last year – Wealthfront and Betterment both doubled their assets under management over the last six months.

Venture capitalists have been enthusiastically backing these potential disruptors, with an estimated total of well over $600 million backing these startups. Wealthfront has attracted the most funding with almost $130 million in investments over five rounds.

However, while some startups have been able to grow to a modest level relatively quickly, the question is whether they will be able to sustain this rapid pace of growth, or whether the growth will taper off over time. See Exhibit 2. Not all of the startups in recent years have grown as quickly as Wealthfront or Betterment. LPL launched a mass affluent focused offering called NestWise in 2012 and then shut it down only a year later. Bloomberg Black, a low-cost advisory service, was mysteriously shut down before it opened its doors, likely due to pressure from the core client base of Bloomberg. Other innovative ideas, such as SimpliFi, which offered Sophie, a digital avatar that would serve as a financial adviser, were not able to weather the financial crisis.

Exhibit 2: Growth trajectory of non-traditional wealth management firms

How have traditional players reacted?

Wealth management firms have been adopting digital technologies and business models slowly and selectively. For example, Bank of America now allows customers to link all of their accounts so that they can see a full picture of their financial situation. Vanguard has launched a low-cost managed product offering, available to clients with more than $100,000 of assets. The offering includes a single financial adviser the clients can reach out to remotely through video chat, as well as financial planning, and regular portfolio re-balancing. Schwab has announced that it will launch its own free robo-advice product, “Schwab Intelligent Portfolios” in Q1 2015 – this has the potential to completely disrupt the industry. However, most traditional wealth managers are waiting to see which emerging model proves to be most successful. And others are weighed down by legacy organizational and IT complexity that makes it difficult to innovate. Some others are likely opportunistically looking to make an acquisition. And several players such as Fidelity have launched internal “innovation centers” to come up with the next big idea.

What more can traditional players do?

We do not see an imminent threat of any of these emerging players rising to the level of a Vanguard or Fidelity over the next several years, but they do serve to highlight the gaps in an industry that is ripe for change. We have helped clients think through a four-point agenda for the future. While the specific initiatives vary based on their current business and their beliefs about the future, each of the four actions applies to all traditional players to varying degrees:

- Improve the customer experience—our research has led us to uncover several pain points that wealth management customers currently face:

- Limited transparency – customers want to be able to feel in control of their assets, and want to have visibility into how their assets are performing and what vehicles the firm they use has selected to invest their assets

- Lack of recognition for relationship – many customers are loyal to their advisors or wealth manager, but feel as though they are not rewarded for their loyalty to the firm

- Little connectivity to others – clients want to be able to interact with their peer group to share investing ideas and points of view on providers and products

- The experience is a hassle – customers feel that the experience is not intuitive and getting high quality advice is not easy without being a high net worth individual

- Automate manual processes—as part of eliminating the hassle in the experience, wealth management firms need to automate processes to enable an experience that is fast and simple to use. For example, imaging technologies and e-signatures can simply or at least speed up the account opening process

- Utilize ‘big data’ and advanced analytics—this can be used in a host of ways, including:

- Driving better business decisions, such as deciding which customer segments to target, which customer groups, product types, markets, etc. will drive greatest profitability

- Offering a more personalized experience – analytics can help firms to tailor the experience based on usage behavior, etc. This will help firms to recognize and reward customers for their loyalty, in addition to offering a more engaging experience

- Collecting additional data on customers to drive deeper understanding of customers’ investing behaviors and likely interests

- Nurture a culture of innovation—the largest wealth management firms today are dragged down by their organizational complexity. In order to drive innovation, and to compete with the emerging players, large firms need to find ways to develop cultural norms that forgo hierarchy and encourage business model disruption.

The rise of emerging players has served as a wake-up call for traditional wealth management firms, and we believe the best of the incumbent firms will figure out how to adapt their businesses in ways that acknowledge the power of digital technologies and business models, combined with the brand and reputation that continue to be critical in wealth management. In future articles, we will continue to track how the emerging players are doing, including our view of the underlying economic rationale and sustainability of these disruptive models.