With the worst of the recession behind us, now is a good time for consumer products manufacturers to rethink their pricing and promotional strategies to deliver growth in revenues and profits. Marakon finds evidence that taking steps to move away from deep discounting to consumers can deliver tangible benefits to all parties involved (manufacturers, retailers, consumers).

Introduction

Many consumer products manufacturers are stuck between the twin realities of increasing input costs and continued pressure from retailers to heavily promote and discount pricing on their portfolios. However, with the worst of the recession now behind us, there is evidence that consumer buying behavior, while still sensitive to headline price changes, is slowly starting to migrate away from the indiscriminate search for the next deal. In light of this observation, Marakon looks for other ways for manufacturers to improve revenue and margins, and discovers that smarter promotional strategies can deliver improved economics for manufacturers and retailers, without necessarily hurting consumers.

The Race to the Bottom

In recent years, manufacturers, retailers and consumers have altered their behaviors and actions to ride out the difficult pricing environment caused by the recession. Most of these were well-intentioned changes meant to cope with short-term problems, but once established, they became the new norm and have been difficult to pull back from.

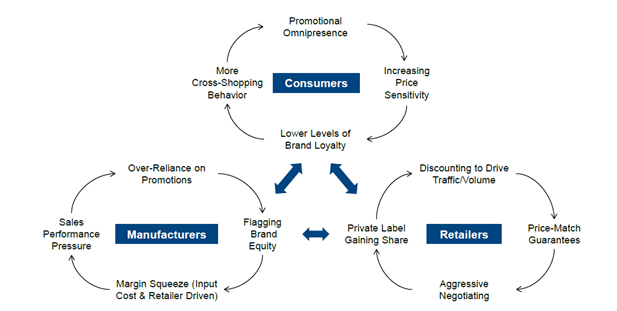

In fact, some of these changes have snowballed and many argue that they may be leading a number of consumer products industries on a downward spiral. For example, in developed and low growth markets like the UK and US, increased headline consumer price sensitivity amidst a tough economic environment led large chain retailers to – among other things – market themselves as strong discounters to drive consumer traffic. In order to fulfill their promises to consumers, retailers consequently had to pressure manufacturers to increase promotions. Manufacturers were willing to play along, as offers could help them boost precious market share during a time of flat industry growth. However, consumers got used to items always being on promotion, becoming less brand-loyal and cross-shopping more often as they purchased whichever brand was on deal. The equity of brands took a hit and became a less significant purchase choice driver, and retailers subsequently felt the need to repeat the cycle by maintaining a high level of promotional activity to keep consumers happy. Frequent and deep promotions hurt retailer margins, forcing them to negotiate even harder with manufacturers, whose own margins were thus also squeezed. And the cycle continued.

Drivers Behind the Race to the Bottom

Early Signs of Changes in Consumer Behavior

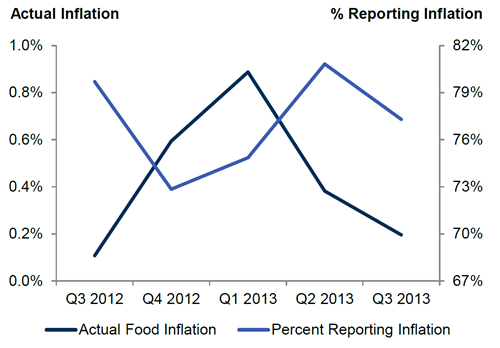

Consumers are still very sensitive to headline prices, and many often perceive them to be increasing at a faster rate than reality. In Wells Fargo’s most recent quarterly US food consumer survey from September 2013, 78% of respondents report material grocery inflation over the last six months, while actual prices were only up 0.2%.

Actual vs. Perceived Inflation (see note 1)

Despite this, The Wall Street Journal reported that average US household spend in 2012 was up, “surpassing for the first time its prerecession peak…as consumers are showing surprising signs of confidence.” (see note 2)

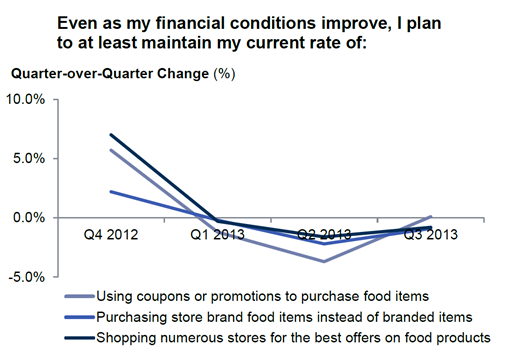

Consumers are not bargain hunting as aggressively as they were even twelve months ago. The same survey cited above reveals that consumer behavior seems to coincide with an economic recovery on three separate metrics:

- Using coupons or promotions to purchase food items

- Purchasing store brand food items instead of branded items

- Shopping numerous stores for the best offers on food products

For each of these metrics, the percentage of consumers who planned to maintain or increase these activities increased quarter over quarter in 2012, but has continuously decreased in each of the first three quarters of 2013.

Consumer Behavior Hinting at Economic Recovery (see note 1)

Raising Price Without Raising Price

As many consumer goods categories become increasingly reliant on promotions, average selling prices (ASPs) are typically significantly below recommended retail selling prices. This, combined with the reduction in consumer bargain-hunting behaviour, gives companies a lot of wiggle room to increase margins by raising ASPs through more effective use of promotions.

Companies can put forward more balanced promotional plans that expertly trade off promotional frequency (how often promotions appear on a supermarket shelf) and depth (how significant the individual discount is relative to non-promoted price) to still offer consumers value while preserving margins for themselves and retailers, resulting in a “triple win”. This type of plan is particularly effective in low growth categories, and in markets where big retail is king, such as the US, UK, Australia and Germany.

In order for this approach to succeed, manufacturers must do six critical things:

- Use smart analytical techniques (e.g., conjoint analysis) to develop an integrated understanding of consumer needs, behaviors and economics, and to bottom-out the likely consumer response to specific changes to promotional depth and frequency

- Develop strong promotional evaluation and modeling capabilities in order to understand, using historical data, the simultaneous impact that individual promotional mechanics have had on manufacturer economics, retailer economics and consumer behaviour

- Create strategies that result in a positive economic equation for retailers, and ensure the sales team has the ability to convince retailers that this will indeed be the case

- Understand competitor behaviour with regards to changes in the company’s own promotional strategy, and create risk mitigation plans against all contingencies

- Balance total brand support carefully between promotions, above the line spend and shopper marketing activity, in order to shift emphasis from “trading” to “brand building”, and begin to reverse any declines in brand equity experienced in recent years

- Deliver all of the above by working very collaboratively across functions, including Marketing, Sales, Strategy and Finance

An Example

The UK condiment market has faced stagnant volume growth and an increasingly high proportion of sales on promotion. Over the past few years, manufacturers have acquiesced to the pressure from retailers to increase promotions, as they were desperate to maintain or grow their market shares. Our client, faced with increasing cost pressures and the realization that promotions were spiraling out of control and having a significant impact on company profitability, decided to take steps to “re-base” the situation with its major customers.

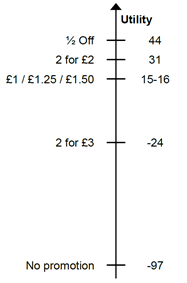

Our client ran a conjoint analysis to better understand consumer willingness to pay around both pricing and promotions. For headline price, the data showed that sensitivity was still relatively high, especially when going over “threshold prices” like £2, which was not particularly surprising given the market situation. What was surprising was the types of promotional mechanics consumers actually ascribe utility to: the data showed that £1 deals were not in fact the consumer favourite, but tied for third place with “shallower” £1.25 and £1.50 deals.

Consumer Promotional Preferences

At the same time, rigorous pre-and-post evaluations were set up for every promotion account-by-account, which not only showed which promotions were most effective for the company, but also which promotions were best for the retailer. While retailers continuously pushed for £1 deals, the historical analysis suggested that alternative promotional mechanics (which consumers actually preferred in the conjoint study) could be better for both parties too.

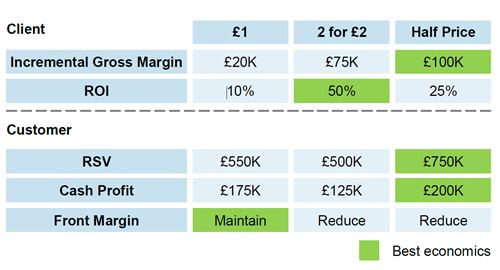

Economics of Different Promotional Mechanics

The combination of these findings allowed Marakon and our client to devise a strategy that lowered the depth of discounts to drive better economics, while maintaining roughly the same number of deals to retain prime retail space and manage against competitors stealing the spots. It gave a few select customers a half-price deal (best economically for them) in exchange for adding 2 for £2 deals (best economically and strategically for us). This plan also helped our client with its goal of moving away from £1 deals by changing many of them out for these new, better promotional mechanics.

This strategy of optimising promotions resulted in an average end consumer price 2% higher and gross margin 7.5% higher than the previous year, which supported the company’s brand objective to move towards a more premium position. It also allowed for a small price increase in the following year, which was expected to deliver an additional ~8% in gross margin. At the same time, the strategy produced better economics for customers while reinforcing their own propositions, and was more in line with consumer preferences. The plan was truly a triple win.

Conclusion

With input costs increasing and retailers constantly applying pressure to provide discounts to support headline-price-sensitive consumers, many manufacturers have felt trapped between a rock and a hard place. However, Marakon, working with its clients, has shown that it is possible to improve margins by raising end consumer prices through smarter promotional strategies in a way that is beneficial for manufacturers, retailers and consumers. While some investment is needed to gather the consumer insights, develop the strong promotional evaluation and modeling capabilities, and embed the culture of close cross-functional collaboration needed to get it right, the returns are more than worth it.